12/10/2020 Opinion

Martí Oliva, professor at the Department of Economics of the Universitat Rovira i Virgili

Auctions that reduce uncertainty and the inner’s curse

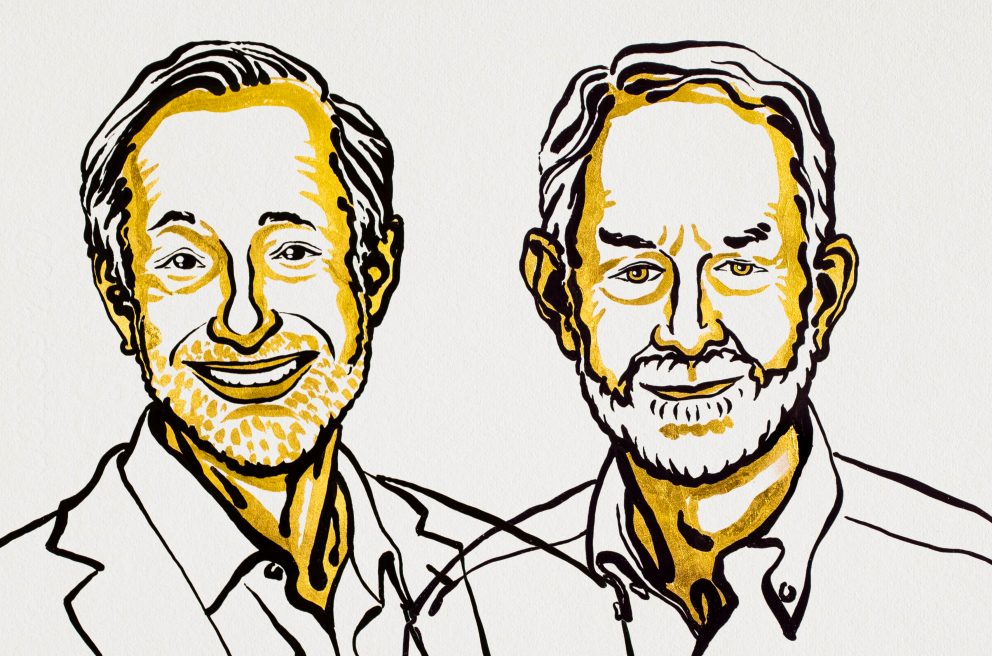

The 2020 Nobel Prize in Economics has been awarded to Paul R. Milgrom and Robert B. Wilson for their advances in auction theory and for inventing new auction formats to the benefit of buyers, sellers and contributors around the world

The 2020 Nobel Prize in Economics has been awarded to Paul R. Milgrom and Robert B. Wilson for their advances in auction theory and for inventing new auction formats to the benefit of buyers, sellers and contributors around the world

Auctions have a long history as an effective means of assigning goods. Despite this, theoretical and applied research in the field continues to generate much interest; for example, in 1996 William Vicrey won the prize for designing generalized second-price auctions.

To understand why Milgrom and Wilson have been awarded the prize, some explanation need to be given of the nature of their work. There are two types of value (private value and common value) and four basic auction formats, these being: first-price sealed-bid auctions in which bidders place their bid in a sealed envelope, the auctioneer opens them and the highest bidder wins and pays the price that he has offered; second-price sealed-bid auction, in which the process is repeated but this time the second highest bid wins; open ascending-bid auctions (English auctions) where bidders make increasingly higher bids and drop out when they are not prepared to bid any higher (as occurs with sales of paintings), and open descending bids (Dutch auctions) where the auctioneer sets the value at a high price and then progressively lowers it until someone makes a bid (as occurs with sales of fish). If the value is private, each bidder has an independent value (as with works of art), whereas if the value is common it is the same for everyone, as in the case of oil prospecting, where the value depends on the resale price of the petroleum, although the different information possessed by the bidders will generate different bids.

Bidders at auctions with common values run the risk that other participants have better information regarding the real value. This leads to the well-known phenomenon of the winner’s curse. The bidder who wins the auction for the oil fields may overestimate their value compared with his competitors and that may mean he loses out in the transaction.

Most auctions, such as those for values, property and extraction rights, have an important common value, that is, the part of the value that is equal for all potential bidders. In practice, bidders also have different quantities of private information regarding the properties of the object. As there is quite a lot of uncertainty, the bidder will make a low bid.

To avoid this problem during the first auction of radio frequencies in the United States and to generate lots of bidders, Milgrom and Wilson designed a new auction format, the simultaneous multiple round auction (SMRA). This offers all the objects simultaneously, in this case radio frequency bandwidths in different geographical areas. By starting with low prices and allowing repeated bids, the auction reduces the problems caused by uncertainty and the winner’s curse. When the US government first used an SMRA in 1994, it obtained a total of 617 million dollars and the process was regarded as a success. Many European countries, such as the United Kingdom, Germany and Italy, have adopted similar schemes for their radio frequency auctions. The advantages brought by this auction system have been highly significant.

The work of Milgrom and Wilson shows that theoretical research can lead to beneficial applications for the whole of society.

More news about: Nobel prizes, Opinion